Cover Image: DAN HIMBRECHTS/AAP Image

Scammers are targeting investors who lost money to a now defunct investment program, that may have also been a scam.

Disclaimer: Connor La Frenais is a relative of "Person 1".

EuropeFX

EuropeFX was an investment brokerage service.

Maxi EFX Global, trading as EuropeFX, was a corporate authorised representative of Union Standard Group Pty Ltd (Union Standard) among BrightAU Capital Pty Ltd (trading as TradeFred).

All of these entities are now in liquidation.

This investigation is primarily informed by experiences of Person 1, who wishes to remain anonymous. Person 1 made contracts for difference trades on foreign currencies through EuropeFX under their advice.

Moneysmart states that "most people lose money trading CFDs".

Photo: Joel Carrett/AAP Image

How did EuropeFX work?

For Person 1, he was contacted almost daily by a EuropeFX broker and they would advise on what to buy/sell. The client would load EuropeFX’s trading program on their computer and follow this advice.

Person 1 said that EuropeFX brokers would discourage clients from withdrawing funds and would instead encourage them to deposit more and more money.

“They are very good at this and this is how they extract so much money from their clients or victims”

EuropeFX's offerings extended beyond CFDs to hedging, shorting and crypto trading, among others.

Person 1’s experiences

Person 1 was originally made aware of EuropeFX through a social media advertisement.

“They had a compelling pitch which got me interested and I think I got suckered a bit at the thought of making some money through it”

Person 1 has a 25-year background in insurance, and was not working at this time, as he was on extended sick leave due to severe mental health diagnoses, and he had several admissions as an inpatient at a private mental health hospital. EuropeFX did not stop contacting him, despite his protests and stating that he was in a psychiatric hospital.

He lost a significant amount of money through a failed CFD trade.

“In short, I bet on certain investments performing a certain way and they didn’t. The thing that exacerbated this was the strategy they used to convince you to continue to invest more and more money”

ASIC takes action

Photo: JAMES ROSS/AAP Image

In 2019, the Australian Securities and Investments Commission (ASIC) applied to the Federal Court for asset restraint orders against Maxi EFX (trading as EuropeFX) and BrightAU Capital (trading as (TradeFred), who were corporate authorised representatives of Union Standard International.

The orders were granted by the Sydney court to protect customers while an investigation was underway.

The asset restraint orders imposed meant that the companies were required to keep certain amounts in separate bank accounts. It also restricted the overseas travel of John Carlton Martin, the director of Union Standard Group and TradeFred. The director of EuropeFX, Eduardo Sasso would need to notify ASIC prior to leaving Australia.

In July 2020, ASIC suspended the Australian Financial Services (AFS) License of Union Standard International Group as they had entered external administration.

In September 2020, ASIC cancelled the AFS License of Union Standard International Group.

In December of 2020, ASIC commenced civil penalty proceedings against Union Standard and its former corporate authorised representatives.

ASIC alleges:

Union Standard provided financial services to clients in China where it was illegal for Chinese residents to deal or trade in foreign exchange contracts.

Union Standard's conduct placed Chinese-based clients at risk of contravening Chinese law.

Union Standard failed to comply with its obligation to do "all things necessary to ensure that financial services were provided efficiently, honestly and fairly" under s912A(1)(a) of the Corporations Act.

For EuropeFX and TradeFred, ASIC alleges they:

provided advice to clients when not licensed to do so

made false or misleading representations to clients about the level of risk their funds were exposed to and the profits that could be expected

used high pressure sales tactics to encourage clients to deposit more money, open more positions or discourage from withdrawing funds

facilitated trading by clients who did not have experience with trading, had a low level of income and lack of understanding of the products issued by Union Standard

failed to accurately disclose the risks involved in investing in its products

ASIC alleges that as the financial services licensee, Union Standard is liable for the conduct of its corporate authorised representatives, and made false or misleading representations to potential clients.

In June 2021, ASIC banned John Carlton Martin, former director of Union Standard, from providing financial services for 10 years, and disqualified him from managing corporations for five years.

ASIC found that Martin's "lack of understanding or regard for compliance was so serious" that it justified the significant action of banning and disqualification orders.

ASIC's civil action against Union Standard is ongoing, with a spokesperson for ASIC saying that it has been dragged out longer than usual.

Not just everyday investors

Photo: Brendon Thorne/AAP Image

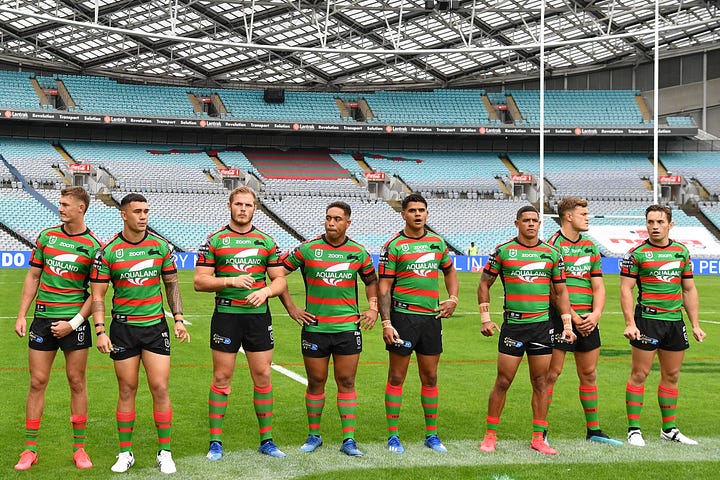

In July 2019, the South Sydney Rabbitohs NRL team announced EuropeFX as its official Foreign Exchange Partner. EuropeFX would be featured on the Rabbitohs playing shorts "for the remainder of the 2019 season, and at least until the end of the 2020 season".

But, EuropeFX's prime placement on the playing shorts did not last until the end of the 2020 season. The below images show EuropeFX featured in Round One, and at a training session in May 2020 as the game prepared to resume after its COVID suspension.

Upon the resumption of the NRL season, however, EuropeFX was nowhere to be seen. The first two games played back, the Rabbitohs wore white 'away' shorts, which did not originally feature EuropeFX. In their third game back, they wore the black 'home' shorts, where EuropeFX was replaced by Menulog.

Photo: AAP Image/DAN HIMBRECHTS

UK law firm Asserton Solicitors operates an online site called Trader Protection, which is verified by the Solicitors Regulation Authority. Service Director Alan Tepfer says that the Rabbitohs sponsorship brought legitimacy to EuropeFX.

“EuropeFX has successfully created the image of a reliable broker. In addition, the sponsorship deal with the Australian rugby team has also given the broker credibility and respect”

He goes onto say that "EuropeFX is not an ideal broker for a retail trader" and he advises people to "avoid opening an account with the broker".

Enter: Legal Recovery Solutions

PHOTO: TIM GOODE/PA/ALAMY

Person 1's last contact with EuropeFX was in July 2019.

On the 9th of March, 2023, Person 1 was contacted by Rose Liston, a Financial Officer with Legal Recovery Solutions (LRS). She informed Person 1 that money that he was told was lost with EuropeFX investments was not, and that after EuropeFX's liquidation, these funds have been re-invested on a "high leveraged crypto platform which has increased your balance substantially". Rose initiated contact via phone, where she listed details of Person 1's original investments that matched exactly. She later sent an email with documentation of Legal Recovery Solution's supposed parent company, LRS Business Consultancy LLP (LRS LLP).

According to Rose's email, Legal Recovery Solutions has been "the trusted name in digital asset recovery since 2017". They use a commission structure, differing to other money recovery scams, where money is requested upfront. Which their clients "LOVE".

“I thought it sounded a bit suspicious, but also viable”

Person 1 looked to see if there was some kind of support available from the Australian Government to find out if the recovery scheme was legitimate - but there is no such support system.

LRS Business Consultancy LLP is a London based business consultancy practice that looks after high net-worth individuals and assists with business and personal financial planning. Lynton Robert Stock is the Managing Partner.

According to UK Companies House filings, LRS LLP was established in August 2020, which contradicts the original email, where it is claimed LRS has been active since 2017. LRS' website has also only been active since January 2023.

LRS claims they are a trademark of LRS LLP, which is not true based on a search of the UK trademark register and trading names search.

The Companies House filings, which were initially provided by Liston in her original email, list Lynton Stock and Gillian Stock as LLP members and persons with significant control of the company.

Lynton Stock and representatives for Legal Recovery Solutions have not responded to attempts to contact them.

The Stock Family

Photo: Accountancy Age

Lynton Stock (pictured) has a vast history in private financial practices. He qualified with Price Waterhouse in 1982 and founded Shelley Stock Hutter LLP, which was sold to Blick Rothenberg in 2017. He retired as a partner at Blick Rothenberg in 2020 and set up LRS Business Consultancy LLP.

Lynton, born 1958, is currently the director of five companies, including Invented Limited, in addition to LRS LLP where he is an LLP designated member. He has 26 former appointments where his position ranged from Secretary, to Director, to LLP member.

Gillian Stock, born 1957, is a non-practicing solicitor. She is the director of two companies, including Invented Limited, as well as an LLP member of LRS Business Consultancy. She has multiple listings on the Companies House database under different addresses.

Sasha Stock, born 1991, is a teacher. She has a former Director appointment to Invented Limited.

Matthew Stock, born 1987, is a practicing solicitor. He is the director of one company, and has a former Director appointment to Invented Limited.

All of the Stock family appointments share addresses. Lynton's history shows four different addresses across his total 32 current and former appointments.

The recovery plan

Person 1 was instructed by Liston to open a Binance crypto wallet, where the lost money would be transferred. The "recovered funds" were invested in the "Ethereum" cryptocurrency. LRS would then allocate the funds to a "cold wallet" with Atomic Wallet, but that then changed to an Infinity Wallet. Inside the Infinity Wallet, Person 1 was shown an amount of over A$300,000.

“My first reaction to that? Holy f***k!... It was a lot more than I originally invested”

Person 1 said that seeing the amount gave him hope and an opportunity to redeem his previous failure.

“[But], these are the tactics they use to manipulate and suck you in”.

He was then asked to provide screenshots of his bank accounts, showing the amount of money that was in them. Person 1 hid some accounts from view and only showed two accounts, with a total amount of approximately A$30,000.

He was then contacted by one of LRS' Head Miners, Charlie Bishop. Person 1 was informed that that he now needs to transfer funds into the Binance Wallet in order to create a "crypto transaction trail". This was supposedly as a transfer of a large amount such as A$300,000 would result in the funds being locked by money laundering regulation bodies, and without a transaction history, there would be no way to get the money back. He was informed that an investment of 10-20% (A$30,000-A$60,000) of the total amount would be sufficient, and that the investment could be gradual.

“That was then a red flag for us. We were told that none of our funds would be needed to facilitate the recovery, but now we are told otherwise”

Person 1 informed Rose Liston that he had become uncomfortable moving forward. He was then contacted on the 21st of March by Sam Young, a Head Miner with LRS.

Communication between Person 1 and LRS ceased for a short period after this email.

On the 29th of March, Sam called Person 1. Person 1's wife answered the phone.

“He wanted to speak to [my husband] and I told him that we know it is a scam and had reported to Federal Police - which is technically true, [the AFP] just told me they could not assist, and said to get legal advice. He then began asking 'Why would you do that!?'. I hung up and they kept calling, constantly. From different numbers with a different location each time”

They kept calling every 15-30 seconds for approximately one hour.

That was the last time Person 1 heard from LRS.

Users on Reddit have shared their experiences with the LRS scam. One user even fell for it and lost more money.

So far, nine other users have posted their experiences on the "r/Scams" subreddit post.

ACCC and ASIC warnings

Photo: AAP Image/DAN HIMBRECHTS

The ACCC and Scamwatch again warned of money recovery scams on the 5th of April. Australians have lost over $270,000 to money recovery scams so far this year - an increase of 301 per cent, compared to last year.

ACCC Deputy Chair Delia Rickard said that scammers will ask for money and personal information in order to "help", before disappearing.

“Money recovery scams are particularly nasty as they target scam victims again. These scams can lead to significant psychological distress as many of the people have already lost money or identity information”

She said that if you are contacted by someone offering to help recover scam losses for a fee, it is a scam.

“Hang up the phone, delete the email and ignore any further contacts”

A spokesperson for ASIC said when recovering money from scams, people need to be wary of unsolicited offers to help recover funds for payment.

“People should never pay upfront for a refund or for help with a refund”

If consumers think they have been scammed, ASIC says to follow these steps.

1. If you transferred funds via bank transfer or credit card, contact your financial institution immediately. They may be able to reverse the transaction. If you have paid scammers via crypto-assets, your bank or credit union won’t be able to assist. As most of these scams originate overseas, once money has left Australia, it is hard to recover. Unfortunately, ASIC cannot assist in getting money back.

2. If you think you or someone you know has been scammed, lodge a report of misconduct with ASIC and report the matter to police. You can also make a report to the Australian Cyber Security Centre at ReportCyber. Your report may disrupt the scammers and may assist in alerting others.

Further support is available

If you need someone to talk to, contact: Lifeline on 13 11 24 (24 hours) or Beyond Blue on 1300 22 46 36 (24 hours).

If you are experiencing problems with debt, contact the National Debt Helpline on 1800 007 007 (Monday to Friday 9.30am to 4.30pm).

Originally produced May 2023.